Introduction

We collected data on 19,294 California properties using our Zillow Real Estate Data Scraping tool and delved into the analysis to glean intriguing findings.

In the dynamic landscape of real estate today, accessing and dissecting precise data is paramount for informed choices. Utilizing Zillow’s housing data, both businesses and individuals can uncover profound understandings of market shifts, price trends, and buyer inclinations.

This blog delves into the pivotal role of web scraping in deciphering real estate market dynamics, highlighting the transformative potential of extracting insights from platforms like Zillow. The analysis draws from data sourced via the Zillow Data Scraper by Actowiz Solutions. As we progress, we’ll unpack the revelations stemming from our thorough examination of over 19,294 properties listed on Zillow in California.

Analyzing Real Estate Trends Using Zillow Data

Extracting insights from Zillow’s extensive property data opens doors to comprehensive details on listings, pricing dynamics, unique features, and overarching market shifts. Such a methodological approach equips experts with the tools to discern current market dynamics and forecast future trajectories in real estate.

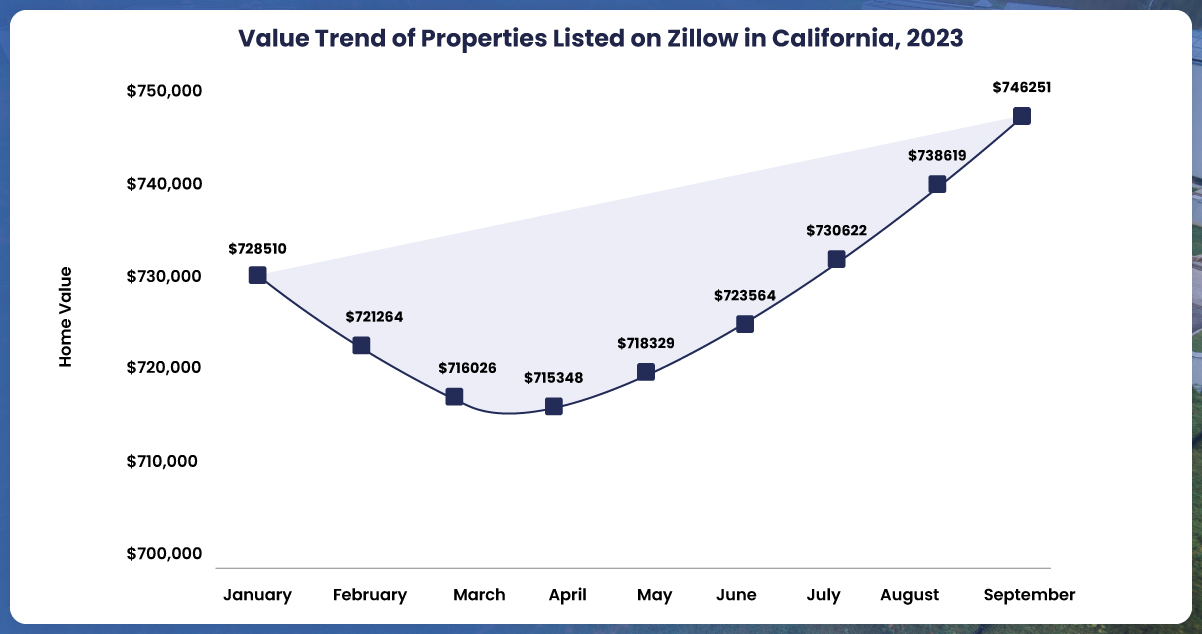

To illustrate, based on our findings, California’s median home prices commenced at 729,610 USD in January 2023. A marginal decline was observed in February and March. Yet, come April, a consistent resurgence began. By September, the pinnacle was reached, with home values touching 747,352 USD, signaling a positive momentum in California’s real estate landscape for that year.

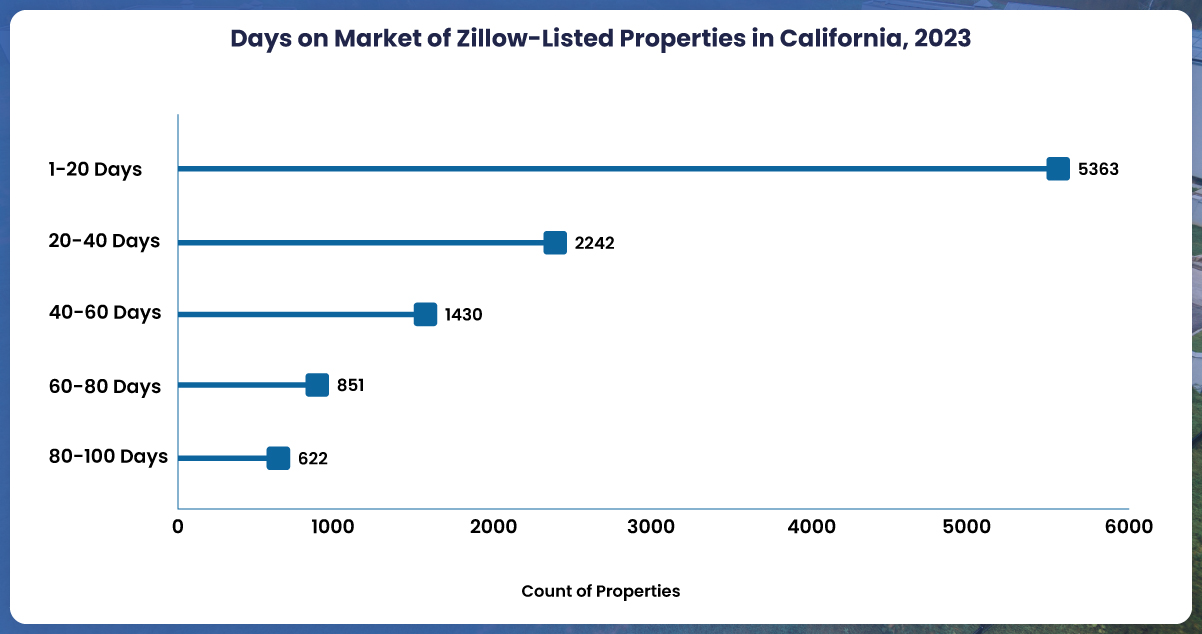

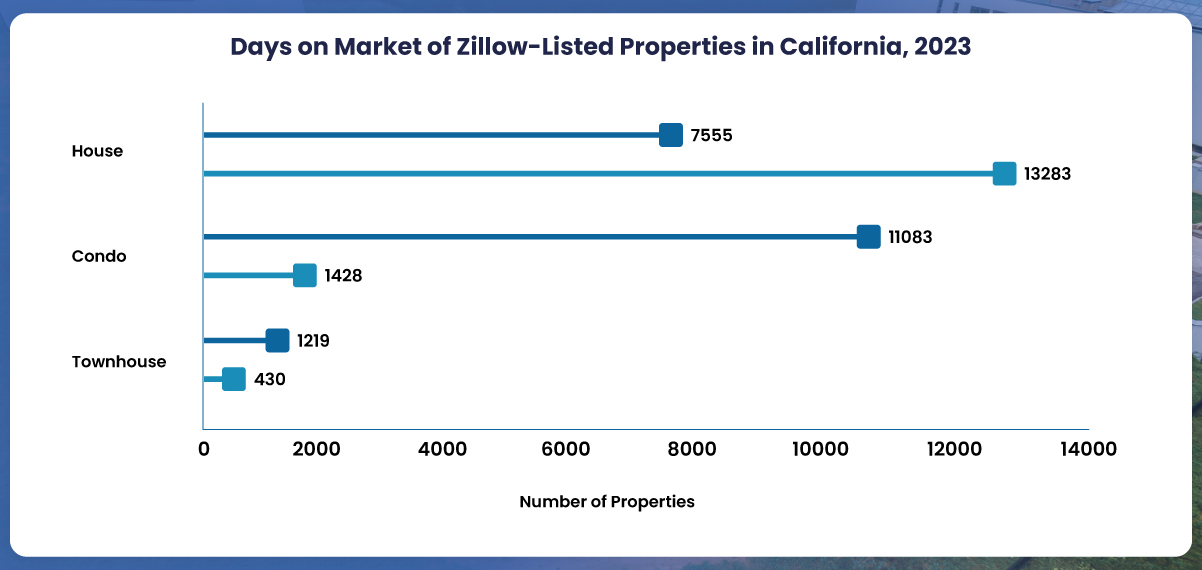

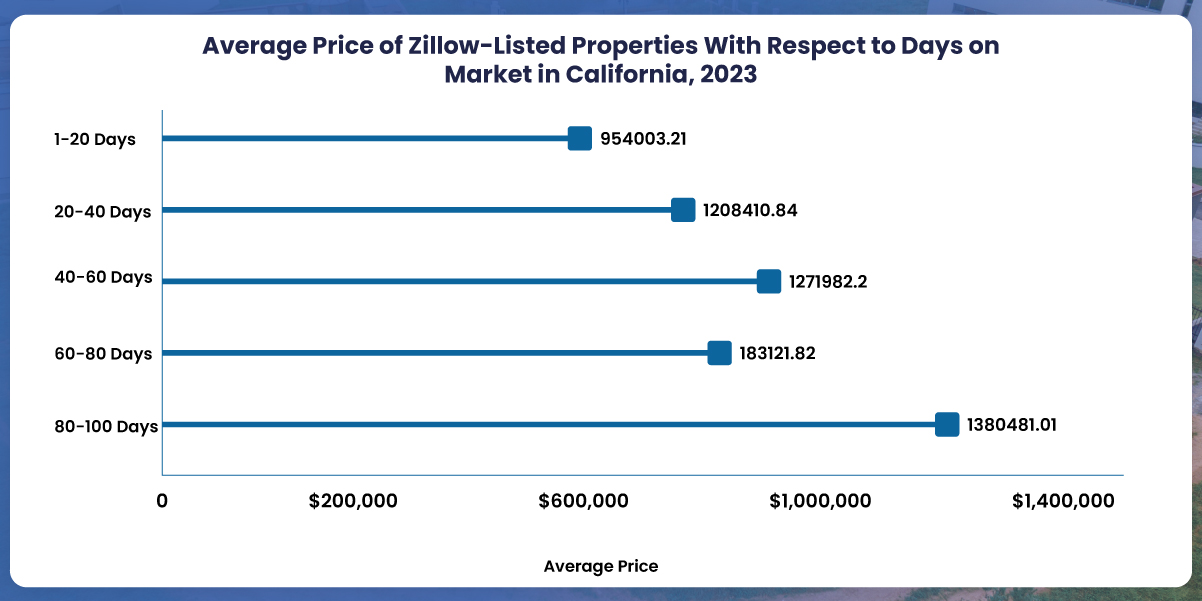

In the realm of real estate, the period a property stays showcased on Zillow before its sale is a pivotal indicator. This metric, commonly known as ‘Days on Market’ (DOM), provides essential cues to real estate experts about the market’s vitality and the patterns of prospective buyers.

Our data analysis reveals that a notable chunk of California properties (5,363) change hands swiftly within 1 to 20 days, emphasizing the state’s vibrant and rapid real estate landscape. This surge indicates fervent buyer demand and an intensely competitive market where listings are promptly acquired after their debut. Properties lingering longer on listings are becoming scarce, hinting at potential factors diminishing their broad appeal.

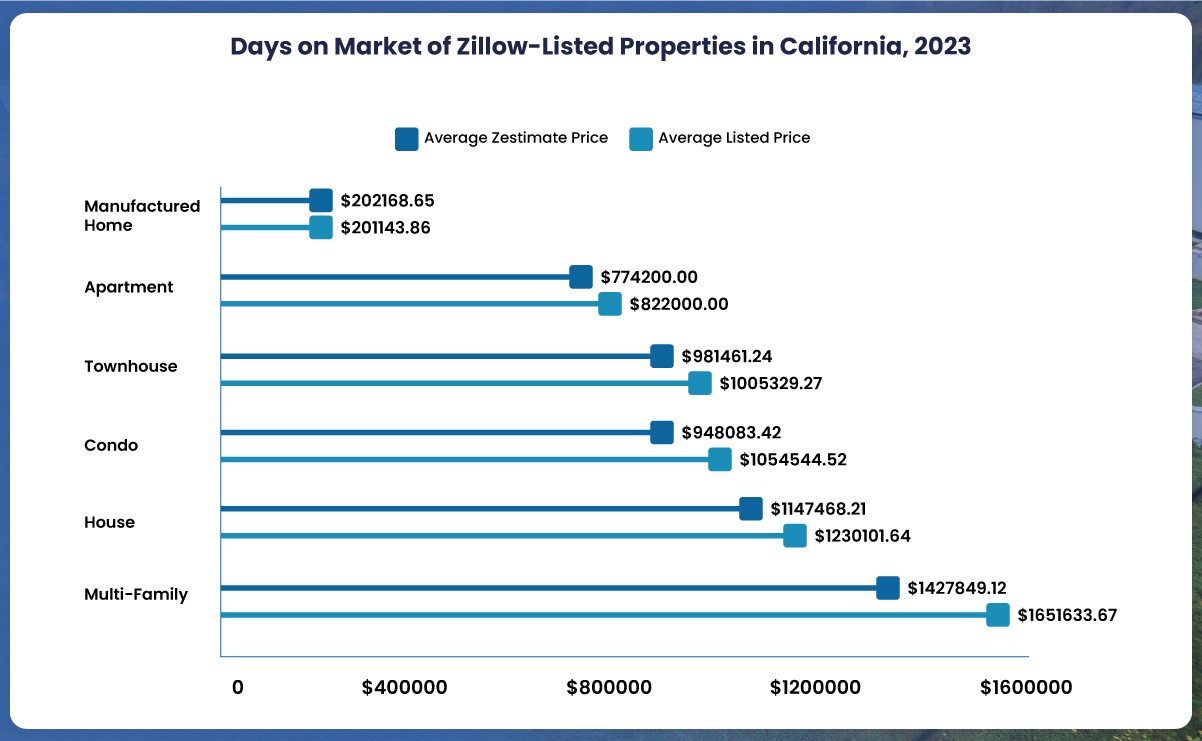

Using its distinct algorithm, Zestimate, an iconic Zillow feature, offers a ballpark figure for property values. While it serves as a preliminary valuation tool, juxtaposing Zillow’s market reports with our insights uncovers a noteworthy pattern: Zestimates frequently trail the actual sale prices.

Deciphering Market Dynamics Through Zillow Data Analysis

In real estate, staying ahead necessitates a deep dive into precise and expansive data, with Zillow housing data standing out as a cornerstone. Leveraging Actowiz Solutions’ Zillow Data Scraper to extract insights from Zillow empowers real estate professionals with a treasure trove of information. This data is instrumental in decoding market shifts and discerning evolving consumer inclinations.

Drawing parallels between rental and sales properties offers profound insights. A dominance of properties on sale, as opposed to those for rent, may hint at a robust, homeowner-centric market. In contrast, a higher inventory of rental properties might reflect a community characterized by mobility or a focus on investment.

Our data underscores this dichotomy. A notable surplus of houses listed for sale (13,283) compared to rentals (7,555), signaling a pronounced tilt towards homeownership. Such a trend suggests a settled, family-centric locale valuing enduring residency and property ownership.

However, the landscape shifts when considering condos and townhouses. The data reveals a stark contrast: most condos (11,083) are available for rent, dwarfing the sales listings (1,428). Townhouses echo a similar sentiment, with 1,219 for rent instead of a mere 430 for sale. Such a scenario hints at these properties’ appeal to transient populations, students, or professionals prioritizing rental flexibility. Furthermore, it underscores a notable investor footprint, with properties often acquired for rental yields rather than outright sales.

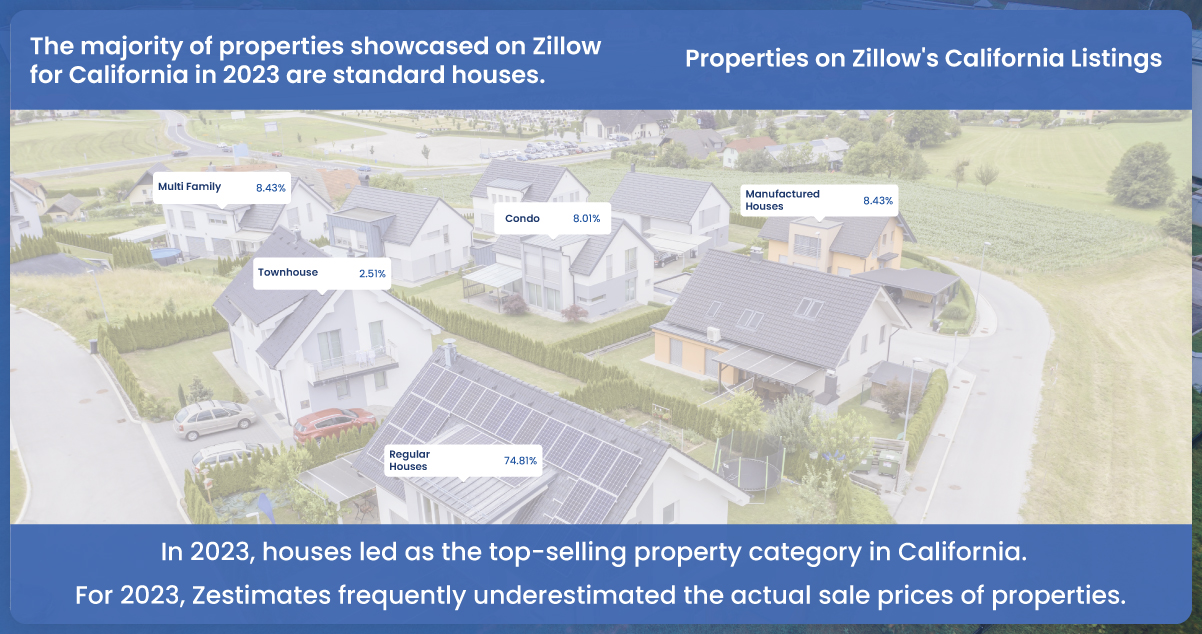

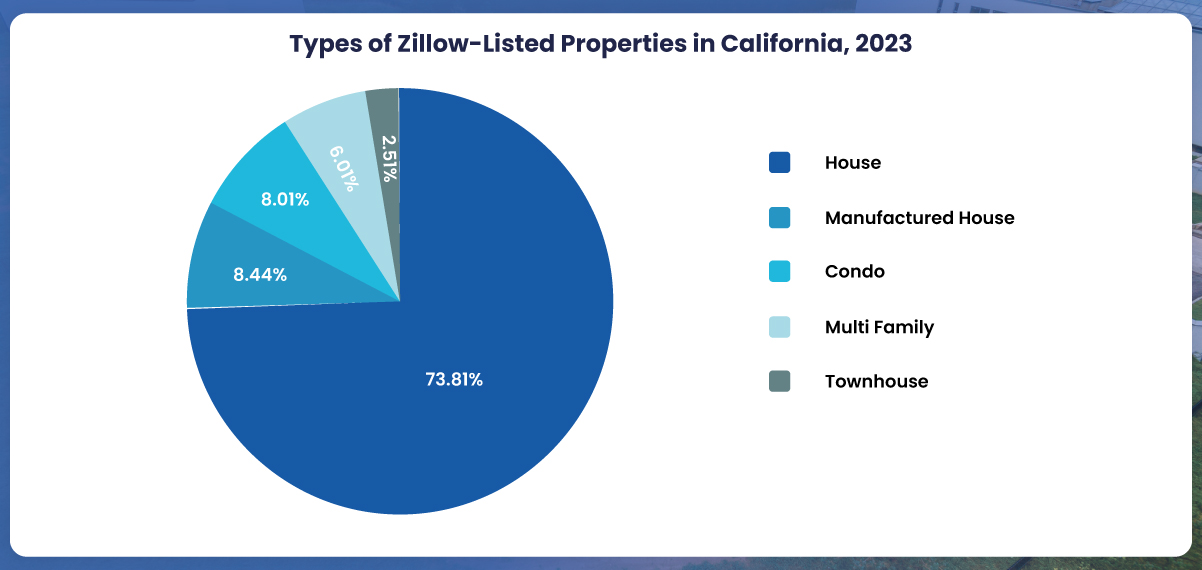

Through Zillow Real Estate Data Scraping, one can gauge the distribution of various property types prevalent in the market. Predominantly, 73.81% of Zillow’s listings spotlight traditional standalone houses, underscoring a pronounced inclination towards classic single-family dwellings. This penchant for houses likely stems from aspirations for spaciousness, seclusion, and the allure of owning a home within a familial ambiance.

Concurrently, manufactured homes carve out an 8.44% share, spotlighting a segment of the market drawn to cost-effective and potentially adaptable housing alternatives. Condos, representing 8.01% of the listings, resonate with individuals or couples prioritizing a hassle-free living experience.

The 6.01% stake held by multi-family homes signals an avenue ripe for investment, given their capacity to accommodate multiple lessees. Meanwhile, townhouses, constituting a modest 2.51%, cater to a specialized demographic seeking a blend of standalone house and condo attributes.

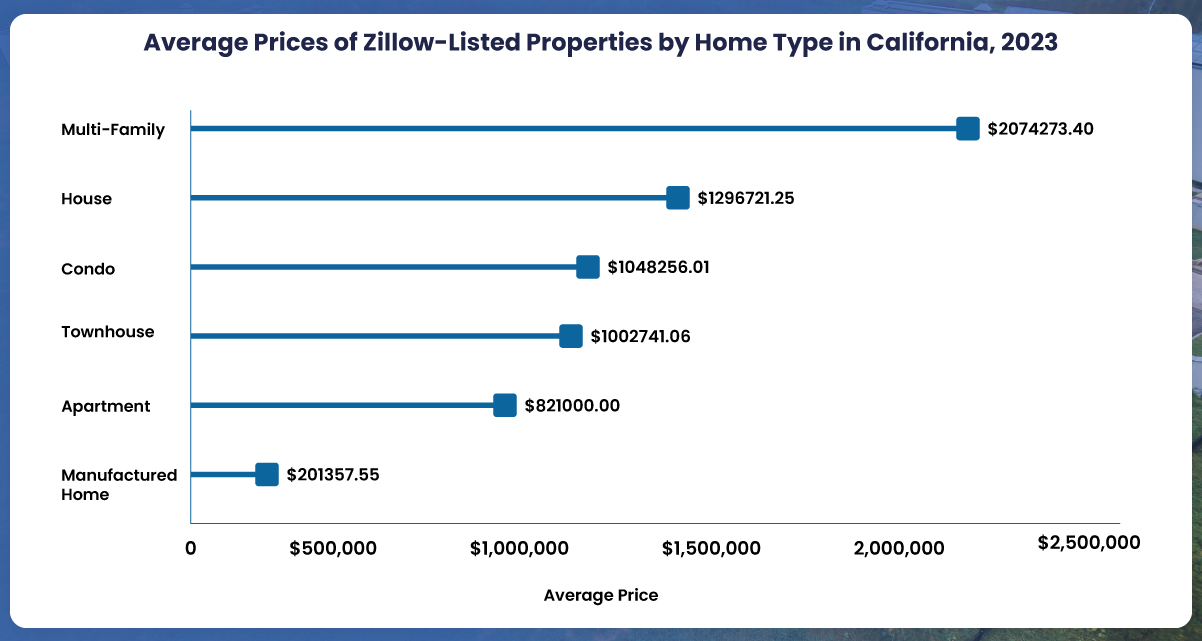

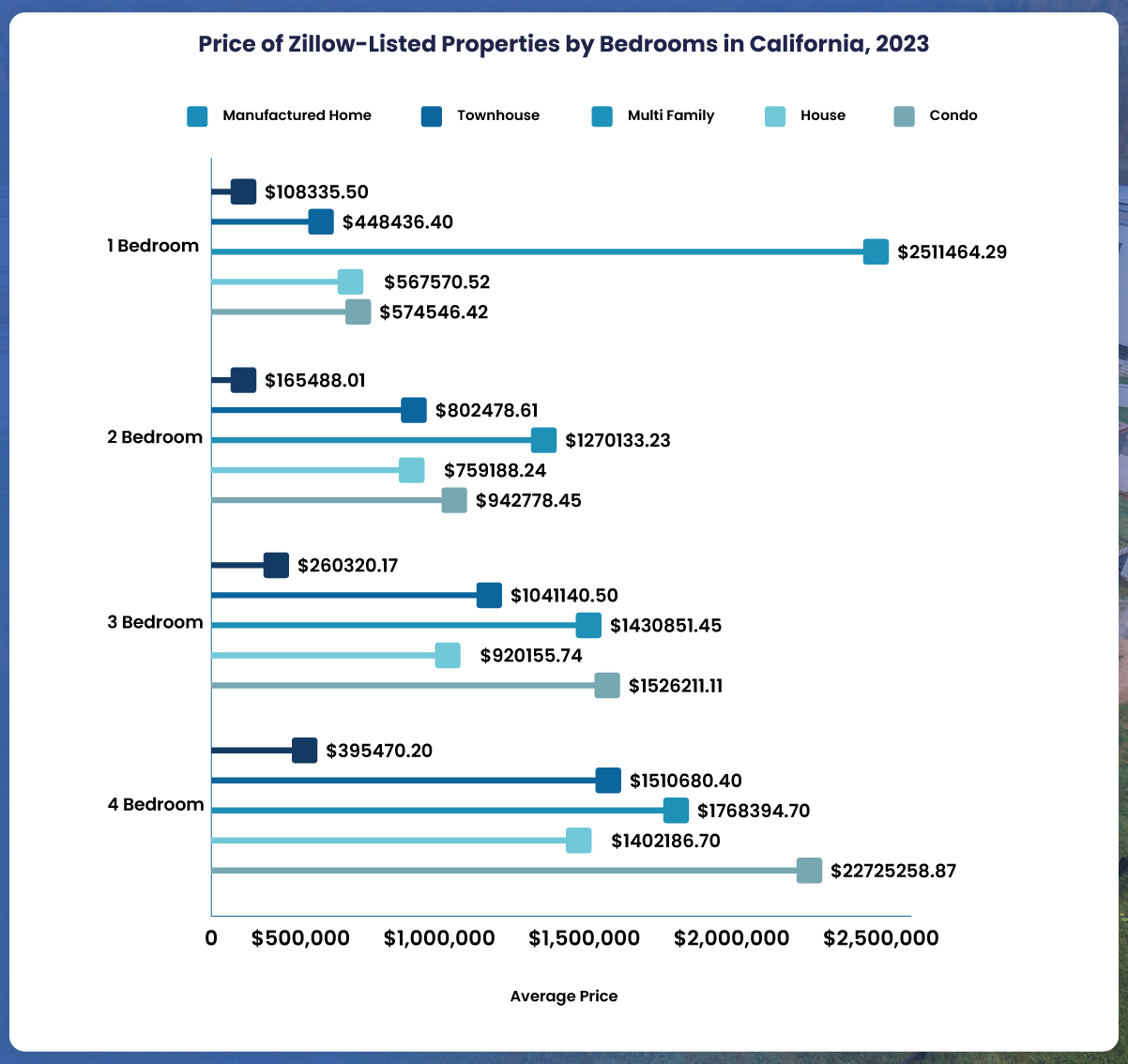

Delving into the average pricing across these Zillow-listed property categories furnishes invaluable insights into prevailing market valuations, elucidating the relative worth of distinct property genres.

Deciphering Property Worth Using Zillow Data

Determining property value is a pivotal element in real estate, demanding accuracy and up-to-date information. Employing Real Estate Data Collection services to extract insights from Zillow equips real estate experts with the indispensable data needed to evaluate any property’s worth meticulously.

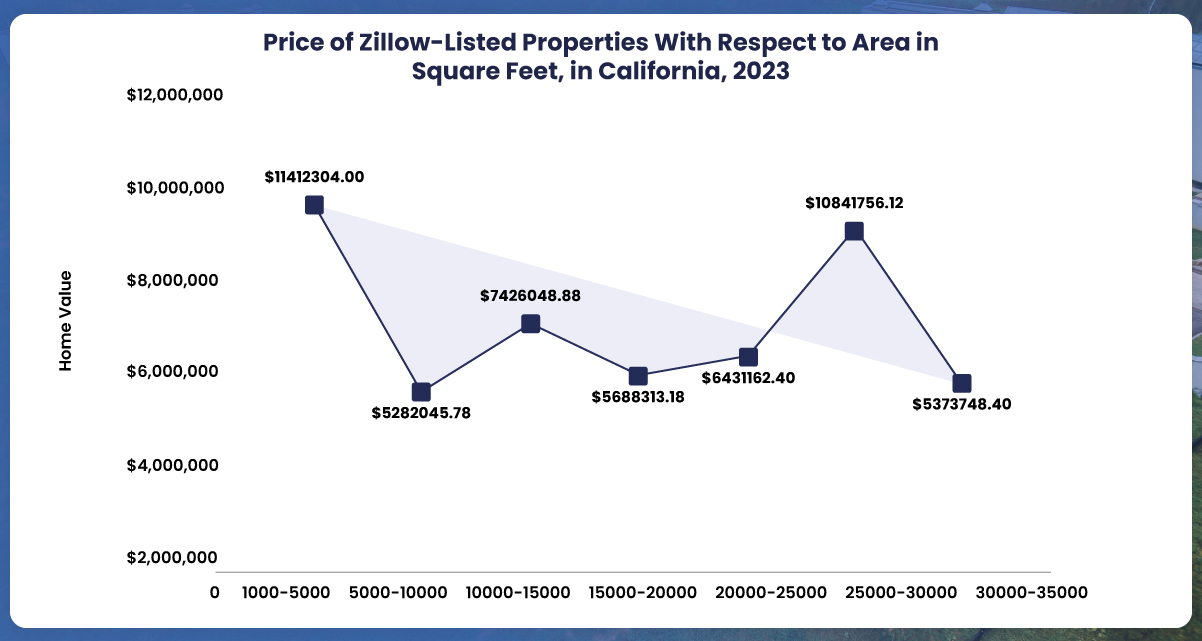

The depicted graph, juxtaposing average property prices against square footage, unveils pivotal correlations between size and value. This analytical perspective, harnessed from Zillow data via Actowiz Solutions’ Zillow Data Scraper, elucidates prevailing market valuation patterns.

For instance, locales, where expansive properties fetch notably elevated prices, suggest a pronounced valuation on spaciousness. Such insights can significantly shape real estate transactions, guiding buyers and sellers. Notably, the 1000-5000 square feet bracket emerges with peak average prices, underscoring the premium attached to properties within this size range. Conversely, the 5000-10,000 square feet segment records more modest average prices, positioning it as a comparatively budget-friendly zone.

Analyzing the pricing variations of Zillow-listed properties based on bedroom count provides valuable insights into the influence of bedroom quantity on a property’s market worth. In regions where extra bedrooms substantially elevate property values, it suggests an increased appetite for family-centric residences or rental accommodations designed for expansive households.

Leveraging Zillow Data for Optimal Investment Returns

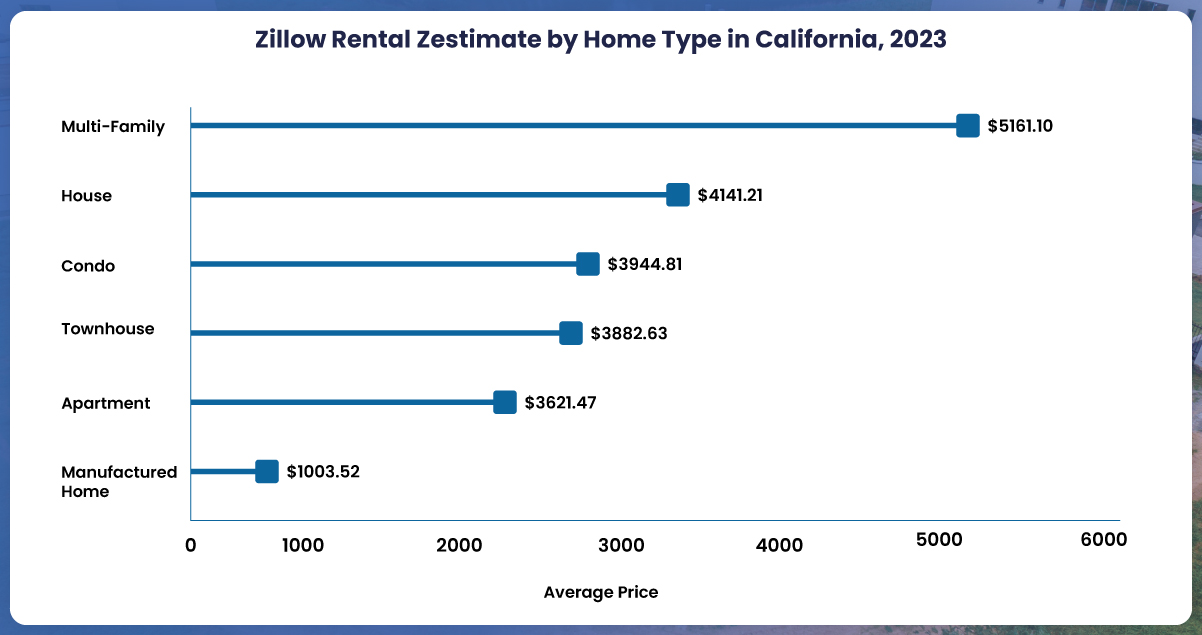

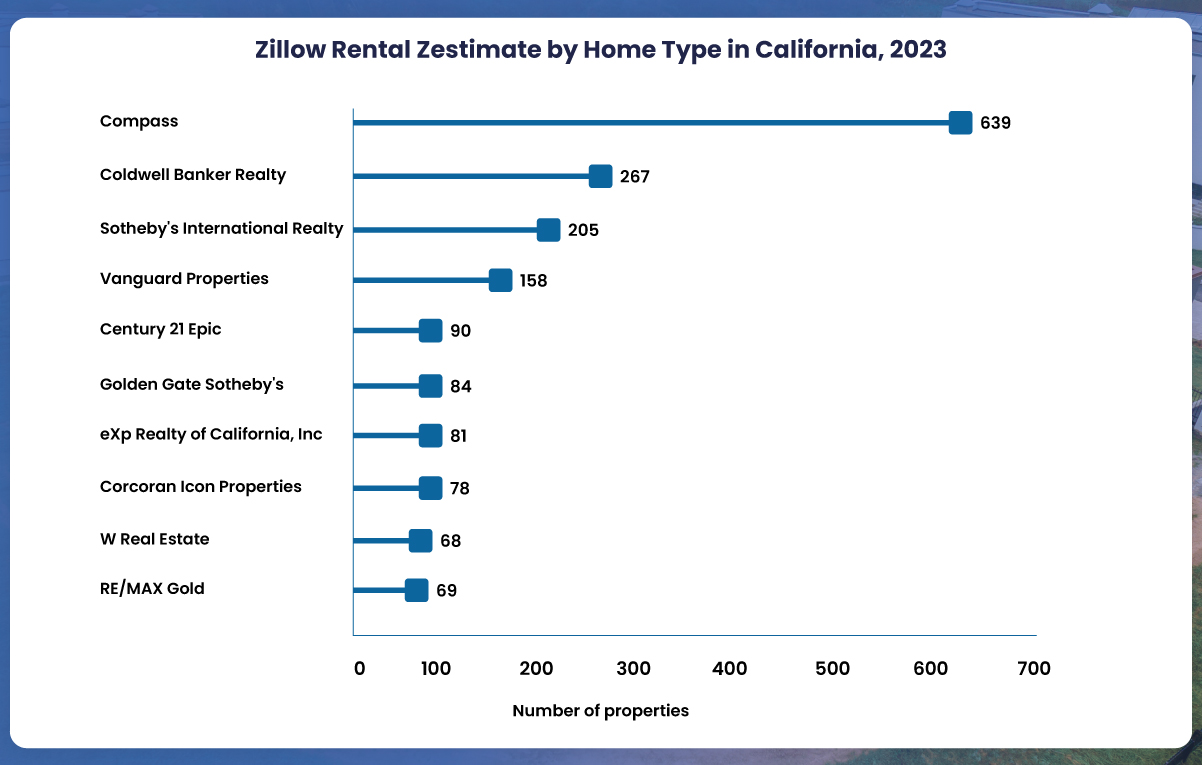

Examining Zillow’s rental zestimate across various home types in California serves as a strategic tool for investors. For example, a higher rental zestimate for multi-family homes than townhouses could signal a more lucrative rental landscape for the former in that specific area. Such insights empower investors to deploy resources, aiming for enhanced profitability strategically.

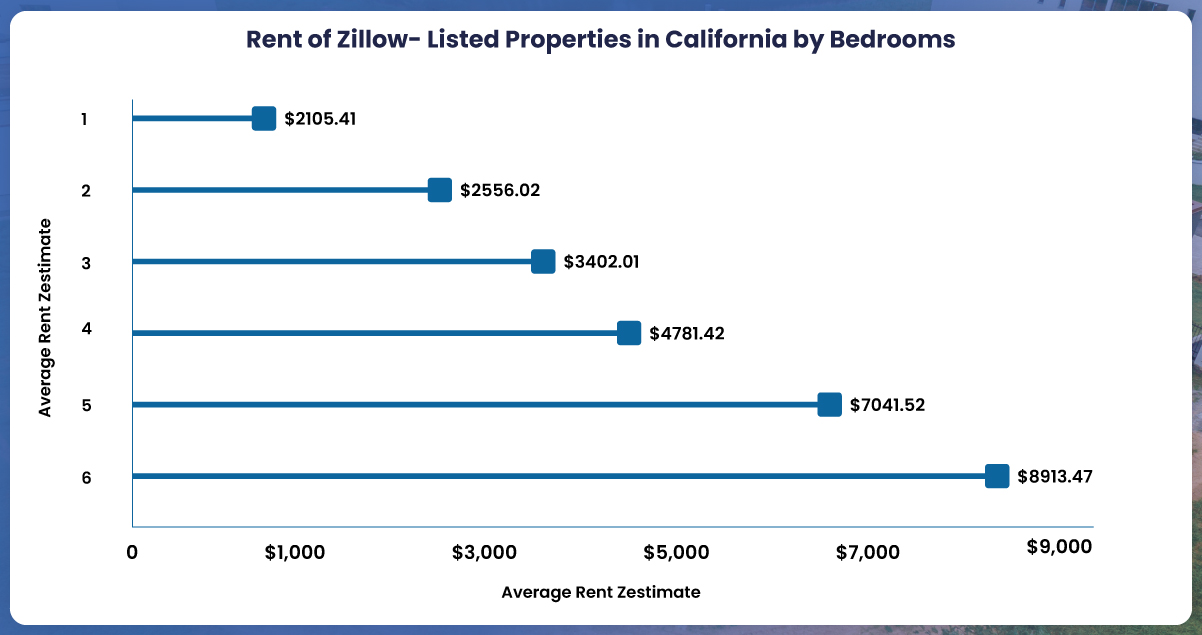

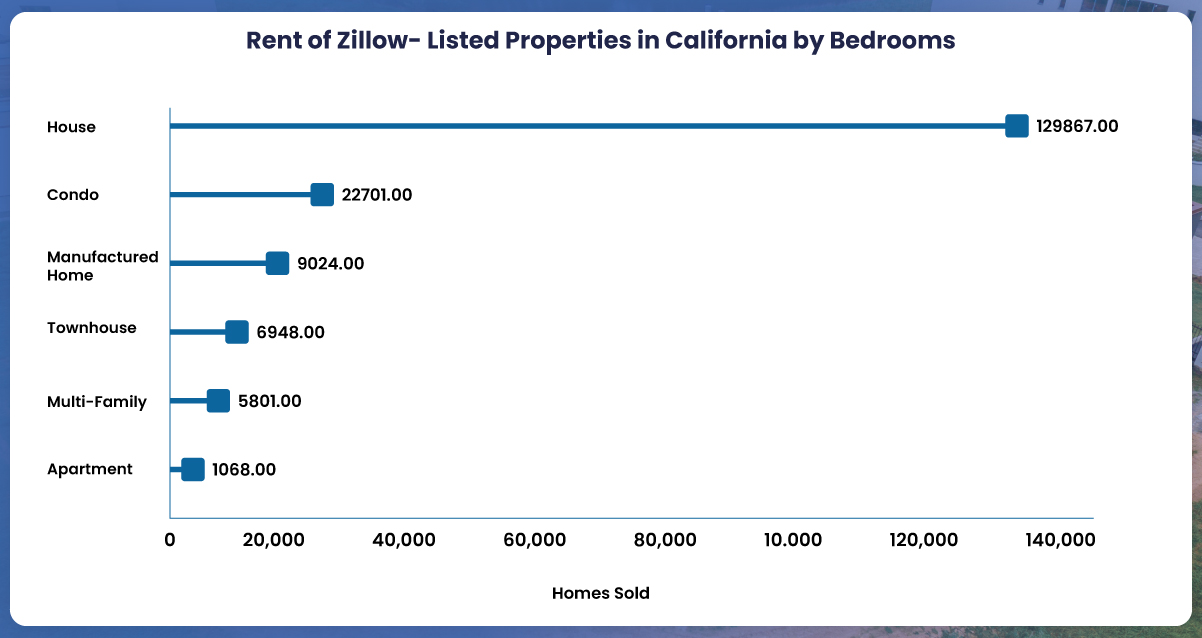

Analyzing the rental rates of Zillow-listed properties in California based on bedroom count offers invaluable insights into the rental landscape. Such data reveals which property layouts yield the highest rental yields. Elevated rents for properties boasting more bedrooms may indicate a preference for larger family residences or communal living setups, influencing investment decisions to capitalize on these trends.

Decoding Real Estate Trends Using Zillow Data

The ever-evolving real estate landscape, molded by economic shifts and evolving consumer choices, becomes more transparent through in-depth data analysis from platforms such as Zillow.

The relationship between listing duration and property valuations unveils critical dynamics within the real estate realm. Our analysis indicates that properties priced on the lower end often secure buyers swiftly, typically within 1 to 20 days, highlighting robust demand for such affordable options. Conversely, higher-priced listings frequently remain unsold for prolonged periods, sometimes exceeding 100 days. Such prolonged listings suggest these properties are priced above market expectations or perceived as lacking value for their cost. This emphasizes the pivotal role of strategic pricing in real estate, emphasizing that aptly priced properties tend to garner quicker buyer interest.

The nature of properties transacted provides notable revelations. In 2023, the California real estate landscape distinctly favored houses, recording an impressive 127,857 sales. Condos and manufactured homes trailed but still garnered considerable interest across diverse market sectors. In contrast, apartments lagged with a mere 1,067 units changing hands. Collectively, these transaction metrics underscore California’s preference for conventional, expansive, and secluded housing options, with a comparatively subdued appetite for the compact, shared environments characteristic of apartments.

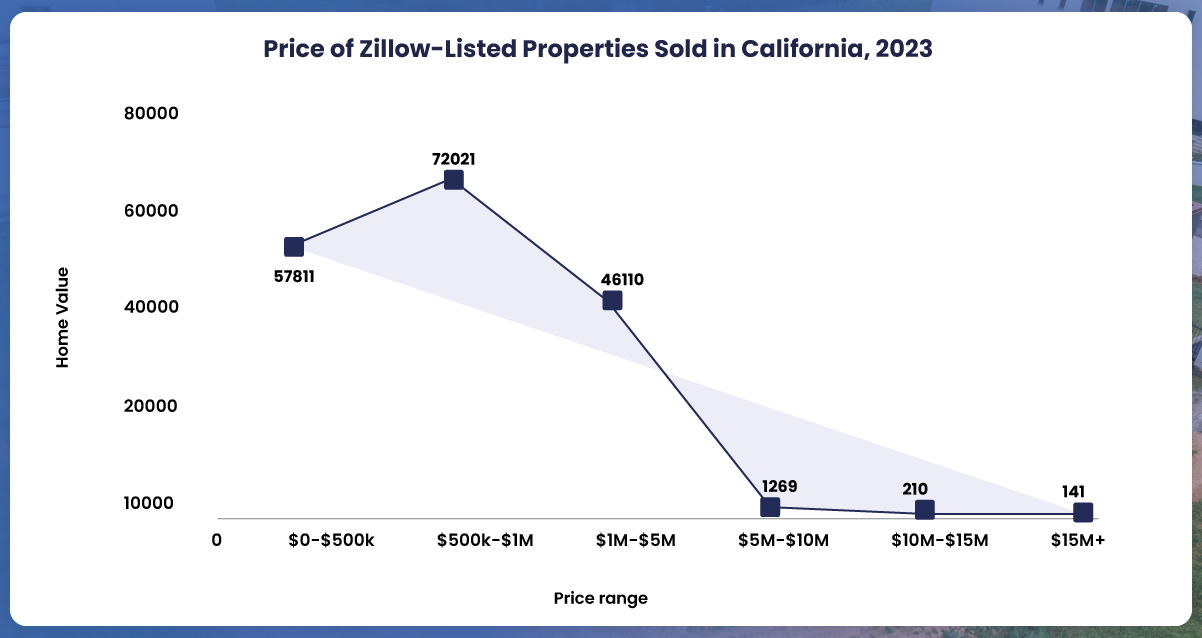

Analyzing property transactions in California over the recent six-month period, mainly when categorized by price segments, illuminates active market sectors and evolving consumer behaviors. Notably, 71,051 properties were sold within the 500,000 USD to 1 million USD range, indicating its appeal to many buyers, encompassing middle-income families, newcomers to the property market, and discerning investors.

Conversely, as the price brackets ascend, there’s a discernible decline in transaction volumes. From 5 million USD to upwards of 15 million USD, the luxury segments record notably fewer sales. This disparity underscores California’s buyer demographics’ distinct purchasing capacities and economic preferences.

Examining the volume of properties listed by various real estate agencies on Zillow reveals their market dominance and impact. Such insights spotlight the competitive landscape and illuminate how different agencies cater to evolving consumer demands. For brokers, this data extracted from Zillow offers invaluable guidance, aiding them in refining their market strategies and positioning.

Closing Thoughts

The revelations extracted from Zillow data through Zillow Real Estate Data Scraping shed light on various dimensions of the real estate arena. The insights gleaned from discerning pricing trajectories, decoding consumer inclinations, or grasping market shifts are paramount. They not only pave the way for informed choices but also craft strategies attuned to the fluid dynamics of real estate.

Undoubtedly, a Zillow crawler emerges as an indispensable asset in this exploration. Locking a treasure trove of Zillow’s data equips stakeholders with pivotal insights to traverse the market’s intricacies with assurance.

Actowiz Solutions’ Zillow Data Scraper stands out as a potent, streamlined solution for enthusiasts keen on deepening their grasp of the real estate domain. Embrace Actowiz Solutions’ Zillow Data Scraper and soar to unparalleled peaks in your real estate pursuits. Harness the transformative potential of data and embark on your next venture fortified with conviction. For more details, contact us now! You can also reach us for all your mobile app scraping, instant data scraper and web scraping service requirements.

Sources: https://www.actowizsolutions.com/zillows-data-infused-approach-modern-house-hunting.php