In the competitive landscape of the mortgage industry, finding and converting high-quality leads can be the difference between success and stagnation. At the heart of a thriving mortgage business lies an effective lead generation strategy. By leveraging targeted lead generation for mortgage services, you can significantly boost your business growth and achieve greater success. Let’s explore how targeted lead generation can transform your mortgage business and set you on the path to success.

The Power of Targeted Lead Generation for Mortgage Services

1. Precision in Lead Targeting

The key to successful lead generation is precision. Traditional lead generation methods often result in a broad and unfocused pool of prospects, which can dilute your marketing efforts. Targeted lead generation for mortgage services, however, focuses on attracting prospects who meet specific criteria and are actively seeking mortgage solutions. This precision ensures that your marketing efforts are directed towards individuals who are most likely to be interested in your offerings, improving your chances of conversion.

2. Enhanced Conversion Rates

High-quality leads are more likely to convert into clients. By using targeted lead generation techniques, you can identify and engage with prospects who have a genuine interest in mortgage products. This targeted approach not only increases the likelihood of closing deals but also improves overall conversion rates. With leads that are pre-qualified and relevant to your services, your sales team can focus their efforts on high-potential prospects, leading to more successful transactions.

3. Streamlined Sales Process

An effective lead generation strategy streamlines the sales process by providing a steady flow of qualified leads. Instead of spending time and resources on cold outreach or broad marketing campaigns, targeted lead generation ensures that you are consistently reaching out to prospects who are already interested in mortgage solutions. This leads to a more efficient sales process, where your team can concentrate on nurturing and converting leads rather than prospecting.

4. Competitive Advantage

In the fast-paced mortgage industry, staying ahead of the competition is crucial. Targeted lead generation for mortgage services gives you a competitive edge by connecting you with prospects before your competitors do. By utilizing advanced data analytics and targeted marketing strategies, you can capture leads who are actively seeking mortgage services, positioning your business as a top choice in a crowded market.

5. Customized Lead Solutions

Every mortgage business has unique needs and target audiences. Targeted lead generation allows you to customize your approach based on your specific requirements. Whether you are looking to attract first-time homebuyers, real estate investors, or individuals seeking refinancing options, targeted lead generation can be tailored to meet your specific goals. This customization ensures that you receive leads that align with your business objectives and market focus.

How Targeted Lead Generation for Mortgage Works

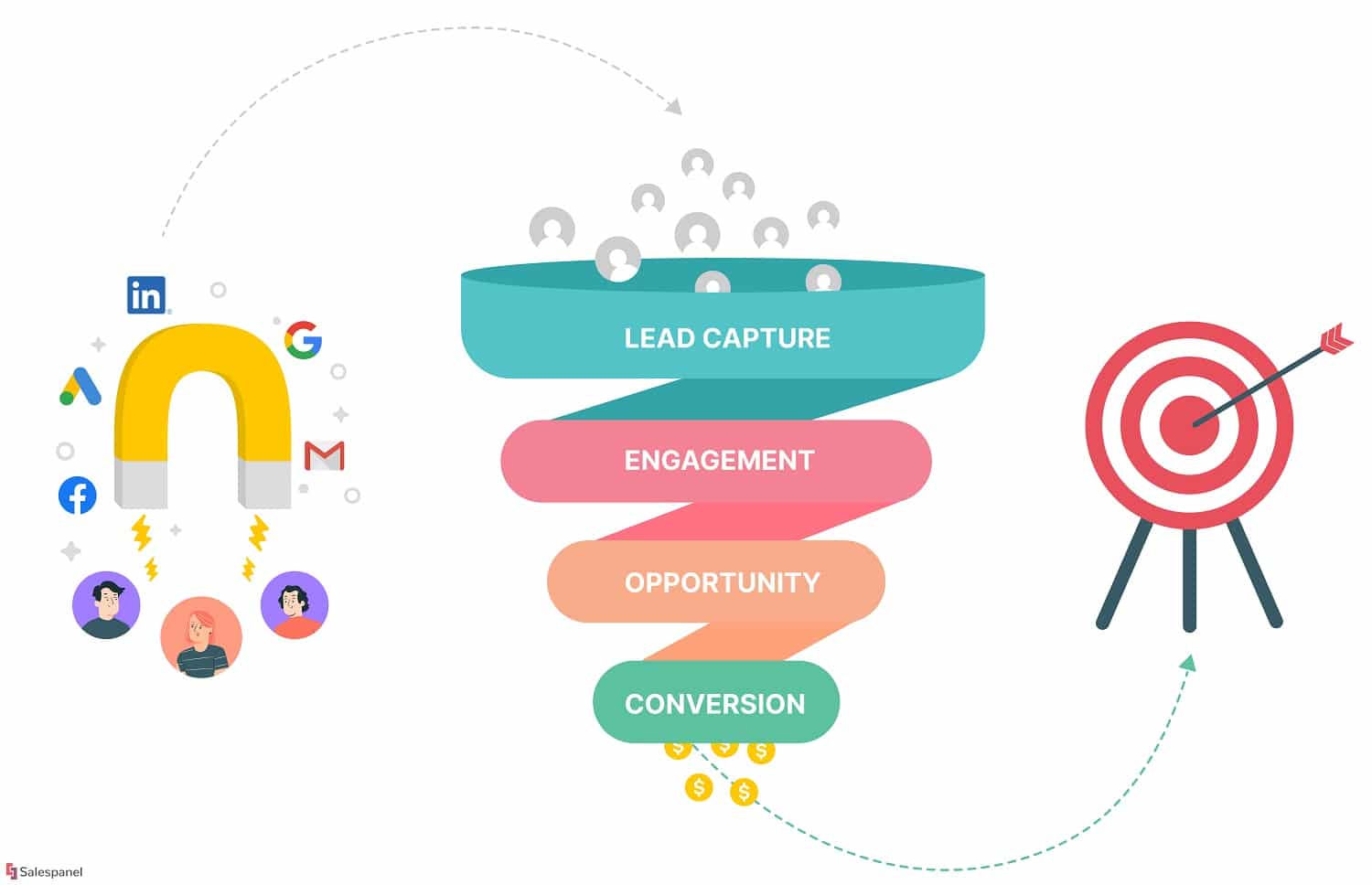

Implementing a targeted lead generation strategy involves several key steps:

- Define Your Ideal Customer Profile: Identify the characteristics of your ideal mortgage clients, such as demographics, geographic location, and financial needs. This profile will guide your lead generation efforts and help you focus on the most relevant prospects.

- Develop Targeted Marketing Campaigns: Create marketing campaigns that resonate with your ideal customer profile. Utilize channels such as social media, search engines, and email marketing to reach potential clients who fit your criteria. Tailor your messaging to address their specific needs and interests.

- Leverage Data and Analytics: Use data-driven insights to refine your lead generation strategies. Analyze performance metrics, track lead sources, and adjust your campaigns based on the results. This continuous optimization ensures that your lead generation efforts remain effective and aligned with your goals.

- Engage and Nurture Leads: Once you have identified and captured qualified leads, engage with them through personalized communication and follow-up. Provide valuable information, answer their questions, and build relationships to increase the likelihood of conversion.

- Monitor and Adjust: Regularly monitor the performance of your lead generation campaigns and make adjustments as needed. Stay informed about industry trends and adapt your strategies to ensure ongoing success.

Start Transforming Your Mortgage Business Today

Targeted lead generation for mortgage services is a powerful tool for transforming your business and driving growth. By focusing on attracting and converting high-quality leads, you can enhance your conversion rates, streamline your sales process, and gain a competitive edge in the mortgage industry.

Ready to take your mortgage business to the next level? Implement targeted lead generation strategies today and experience the benefits of a more efficient and effective approach to acquiring new clients. With the right lead generation tactics, you can unlock new opportunities and achieve greater success in the dynamic world of mortgage services.