Open Interest (OI) is one of the very useful indicators in future and options (F&O) to trend in a particular stock or broader market index trading in the derivatives market. You can use the open interest (OI) data to find out the sentiments of the traders towards a particular stock or indices. You can also analyze the current trend and expected price movement.

For intraday trading or for short-term trading in the F&O segment with the short-term weekly or monthly you can use the open interest to get insight of the stocks trading under this segment. And to use the OI effectively in trading you need to properly read, understand and interpret the open interest (OI) data with examples. That we are going to discuss here.

What is Open Interest in the Stock Market?

Open Interest or OI is the total number of contracts in options and futures or derivatives market held by the traders that are active right now. These positions are still open in the market and not closed, which means neither expired nor exercised within the time frame.

Also Read: What is Futures Trading in F&O: How it Works and Pros & Cons

Open interest keeps changing on a daily basis with the fresh position created pushing the OI up, while when existing positions are closed or exercised the OI decreases. When OI increases, traders create a long position in the stock or in the underlying security or main index like Nifty. When OI decreases, it means, traders create a short position in the stock or underlying security.

Also Read: Nifty Open Interest: How Traders Use Change in Nifty OI for Data Analysis

How to Read Open Interest Data?

Reading the OI is very simple if you have gathered the daily traded contracts of the different stocks and indices. When you see the data of OI, it will be available in the number of contracts which means currently this much quantity of contracts are open in the market.

In the stock market, there are two types of traders – a buyer and a seller and in the derivatives market when a seller sells and a buyer buys 1 quantity, it is counted as 1. Here in the derivatives market, the total number of contracts traded is also called the total number of volumes.

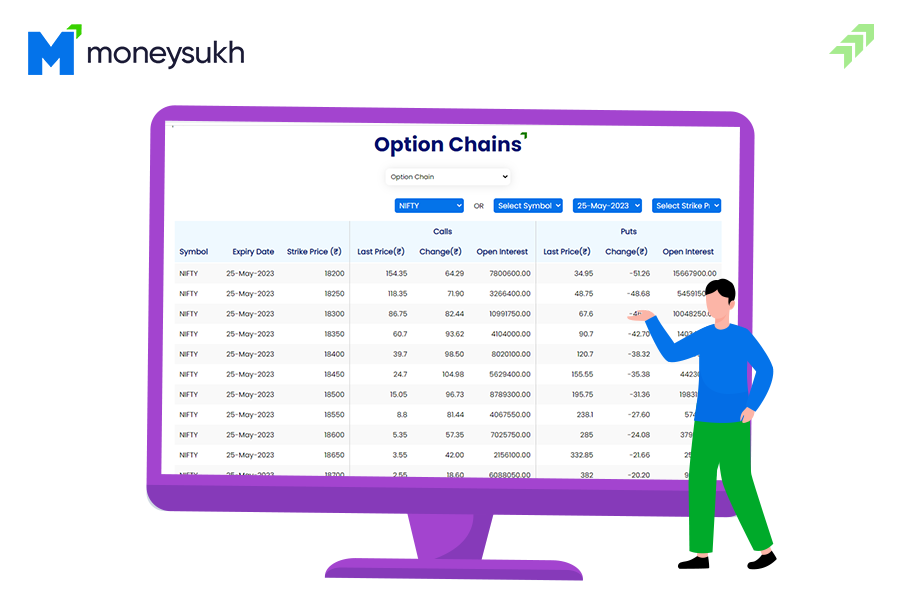

But while reading the OI, make sure it is a number of future contracts or options contracts or both. However, when you see trading details of a stock or index future it shows only the number of futures contracts and when you see an options chain, it shows the number of contracts of that particular security of a particular month contract with a change in the OI.

Also Read: What is Nifty Future: Lot Size & How to Trade in Nifty Futures

How to Understand Open Interest?

To understand the OI, you need to understand how OI is calculated. As we have told you earlier, when two parties (buyer and seller) enter into a fresh position, the open interest is increased by one contract, and when they close their position or exercise their contract, the open interest decreases by the same number. But at the same time, multiple buyers and sellers enter or close the contracts then a net increase or decrease of IO is considered.

Let’s make you understand through an example, in a derivatives segment when a seller sells 1 contract and the buyer buys the same contract, it is counted as a single contract, though the buyer is in the long position, the seller is in the short position in the same contract. The increase in the open interest reflects the flow of money into the market, while a decrease in the OI indicates that money is flowing out of the market. And if there is no change in the OI, it means the money is neither coming nor going from the market.

How to Interpret Open Interest?

When you understand the relationship between the volume of trade and the change in price of the underlying security or index you can interpret the open interest. And there are various situations when OI changes with the price change that are listed below.

Situation 1

When open interest increases and the price of the underlying security or market index also increases, it means the market is bullish or the price of the underlying security will go up.

Situation 2

When open interest decreases and the price of the underlying security increases, it indicates the market is bullish but there is a chance of trend reversal and the market will turn bearish.

Also Read: Bullish Trend Reversal Candlestick Patterns

Situation 3

In this situation, when OI increases but the price of the market index decreases, it indicates the market is bearish and there could be panic selling in the market or underlying security.

Situation 4

In this combination of OI and price change, when the OI decreases and the price of the underlying security or the broader market index also decreases, then it is considered that the sentiment of the market is bearish.

How to Use Open Interest Indicator?

It is used as an indicator to determine market sentiment and the strength behind price trends.

Though it is not an indicator in itself rather a tool which is used as an indicator to know or predict the trend or if there is any trend reversal in the price of the stock. However, you can use the OI for intraday or short term trading but only in the index or stocks included in the F&O segment.

Also Read: Short Term trading v/s Intraday trading: which one is more profitable

Though not a technical indicator, the OI, whose changes are governed by news and moments in price due to technical patterns, reflects the sentiments of the traders towards a particular stock or market index that one can use to make the right decision for trading. However, as a technical indicator, you can use the OI for the following trading strategies:

Breakout or Breakdown

When OI is increasing and stock price breakouts from the trading range, the rise in OI and breakout gives the indication of continuation in the current trend.

Also Read: What is Breakout & Breakdown How to Identify Breakout in Stocks

Divergences in OI & Price

For option traders open interest giving them insight into direction of price moment. Tracking OI during earning season can help them to shift their strikes / price moment before the earning news is discounted by investors.

If the price of the underlying security increases but OI is declining, it is giving the signal of a potential trend reversal in the current trend.

Also Read: Which Candlestick Pattern is Most Reliable for Trend Reversal

For Options Trading

Change of open interest while trading in options provides insight of the price trend with the money flow increasing or decreasing in the market. Some trader only sees open interest increase and decrease for short-term trading, day trading and option trading.

How to Use Open Interest for Trading?

You can use the OI for trading with the combination of price change with the change in OI to find out the current trend in the underlying security. And based on the trend and expected movement you can create the long position or short-selling with the right trading strategy.

In the future & options market, you have both choices, either to buy or sell the contracts for a specific expiry month depending on your expectations and trading style. If you want to use the OI for intraday trading also apply the technical indicator on the price chart to get the confirmation of trend and right levels of buying or selling in the underlying security.

Also Read: Top 5 Best Technical Indicators for Intraday or Day Trading

While in future & options trading you have multiple options strategies you can apply depending on the market conditions. From bullish option strategy to bearish option strategy and sideways options strategies, all can be applied with the help of analysing the OI data.

How to Use Open Interest for Day Trading?

For newbie’s intraday trading or day trading can be a risky business but can yield you handsome return if done with proper knowledge. There are multiple technical indicators used to find out the buying and selling levels in the underlying security. OI can be also a part of trading strategy giving more insightful trends in the market with the indication of the flow of money and further trends.

Also Read: How to Do Intraday Trading: Best Stocks, Charts & Strategies

However, we have already discussed how a change in the price with a change in OI gives the trend in the market or underlying security. However, for intraday trading, you need to be very cautious and trade with a more strategic approach like using the volume indicator or technical indicators while considering the various technical and fundamental factors.

Also Read: How to Find Trending Stocks for Intraday Trading: Ten Rules

Identify the High OI Contracts: Find out the contract in the option chain having a significant amount of open interest, which means one of the highest OI levels in the different strike price. Having a high OI in a particular strike price has high liquidity in the market and likely to move further.

Keep Checking the Change in OI: To know the trend keep checking the change in OI in the particular underlying security, if the open interest is building up or shedding. Also watch the price change, if there is any price change with swings or there is any breakout or breakdown.

Correlate the OI with Volume: Change in the price and OI is not enough, the volume of trade also matters a lot to know the right trend and validation of the current trend. Volume plays an important role in technical analysis, and in option trading the volume of contracts traded shows in the form of OI.

Also Read: Importance of Volume in Technical Analysis: Use & Role in Trading

Stay Alert with Market News: Apart from technical factors, various news and events like economic data, corporate earnings reports, company-specific news or any other favourable or unfavourable activity also influence the open interest in the market or underlying security.

Know the Enter and Exit Points: Knowing the right entering and exit point precisely is very important to maximize your chances of profitability. The change in open interest at certain points of price change will tell you the right point of entering and exiting from the trade position.

OI in High Volatile Market: Open interest helps to make the right decision of trading when the market is highly volatile. The change in open interest during uncertain market conditions gives an indication to the traders seeking the right opportunity for protection.

How to Use Open Interest for Swing Trading?

Swing traders can use the open interest to identify the trend reversal or continuation of the current trend. Change in price along with the change in the open interest confirms the entry and exit points while following the swing trading strategies indicators.

OI Build-up: To use the OI for swing trading you can keep an eye on the open interest build-up that can give a price swing indication if the OI build-up is visible during the early stage of trading hours.

OI with Market News: If the OI is changing due to unexpected market news, it will influence the movement of the market index or price of the individual stocks or the underlying security.

OI with Volume: A change in the volume of trade along with a change in IO is another useful indicator for swing trading. You can compare the daily average volume to know if the price is likely to change.

OI Change in Options: In option trading if OI is increasing in Calls, it indicates the market will go up, while the increase in OI in Puts hints the market is likely to fall. OI build-up calls and puts in a particular strike price also indicate the support and resistance levels of the market.

How to Use Open Interest in Options Trading?

In option trading, open interest is playing the leading role for the traders to analyse the market condition and interest or sentiments of the traders towards a particular stock or market index. OI in options represents the total number of options contracts open in a particular underlying security that is traded but not yet liquidated by squaring off the position or exercising the same.

Also Read: What is F&O Margin Penalty: SEBI Rules & How to Avoid it

Each option contracts have a specific quantity of shares in each lot, depending on the market index, liquidity and market price. But change in open interest in such option contract gives the sense of liquidity, activity and flow of the money in the options market or in a particular underlying security. However, you can use the OI in the option market with the approach of various trading strategies.

To know the Market Sentiment

The OI in the options can be used to know the sentiments of the traders in the market or towards the individual underlying security. The increase in the OI means a new flow of money is coming into the market which also indicates the current trend is likely to continue. While decrease in the open interest also gives the signal of liquidation of the market and there could be a trend reversal.

Also Read: What are the Best and most Accurate Trend Reversal Indicators

Indicator of Liquidity Levels

When there is a high OI in a particular strike price of the underlying security or market index, it means the option contract is highly liquid and you can easily find the buyers and sellers at minor price differences. The high liquidity helps to enter or exit from the trade at the desired price and there is also the possibility of significant movement in the market index or in the underlying security.

Support & Resistance Levels

In options trading, you can use open interest to analyse the change in OI in different strike prices to know the potential support and resistance levels. The high open interest in a particular strike price gives you the trading range (resistance and support) for the market.

For the Hedging Purpose

Buying the Calls or Puts in the option market is meant for hedging, especially for institutional investors. However, fund managers at such institutional investors use the open interest data to trade with the motive of hedging strategies, which helps them to earn profits even in adverse price movement of the market or when the stock price is falling.

To Choose the Trading Strategies

One of the best uses of open interest in the options market is that using the OI data you can create various trading strategies. As per the market conditions and expected further movement, the OI increases or decreases. You can also choose the right strike price for trades that have a significant amount of OI that have a high potential to move and can give positive returns.

Summing-up

OI is simply the number of contracts between buyers and sellers traded on a particular day in the derivatives market. The increase or decrease of the OI with the price change of the underlying security or market index gives a bullish or bearish signal.

You can use the open interest for trading, intraday trading and short-term trading. Though OI can be counted only in the derivatives market (F&O), hence you can use the same only in future and option trading. It can give you current as well as upcoming trends and flow money in the market or in a particular underlying security trading in the F&O segment.

Also Read: 7 Biggest Mistakes To Avoid While Doing Intraday Trading

To make better use of open interest in main market index like Nifty 50, you need the accurate data and complete analysis of the same. Reading, understanding and utilizing the OI in trading is possible only with the help of the market experts.

Here you can choose the Moneysukh to help you in trading in the option market with the right trading strategies. You can choose various option strategies for different market conditions like option strategies for a bullish market, option strategies for a bearish market and option strategies for a sideways market created by the market experts.

Moneysukh is one of the best discount brokers in India, providing the best online trading platform at the lowest brokerage charges. You can open demat account and trading account here with the advantage of trading in equity, commodity and forex market.

Here you will also get the opportunity to learn about the stock market, its terminologies, basic concepts and various trading strategies to perform the fundamental and technical analysis. And all these services at the lowest demat account charges in the industry.