Here, we have analyzed Search, Availability, and Promotions for Biscuits, Chocolates, and Malt Drinks in different online apps like Dmart, Swiggy, BigBasket, Blinkit, etc.

Today, brands are tracking to ensure they get peak keyword rankings, optimum availability, and good discounts, and to do this, Brands need Digital Shelf Analytics.

The FMCG Market Growth

FMCG has been overgrown in the past few years because of digitalization and shifting consumer habits. Factors like government impetus, inflationary pressures, and consumption recovery specify a double growth of FMCG brands. As per NielsenIQ FMCG Snapshot Q2 2022, the development of the FMCG industry is 10.9% in the quarter of June 2022 end, compared to 6% growth in the last quarter. In the second half of 2022, customers will spend more during this festive season. With the shifts taking place, the growth prospects in this segment could only be exploited by businesses that can recognize trends early.

To provide retailers and manufacturers some actionable insights into the e-commerce trends, Actowiz Solutions help them in making well-informed decisions and eventually improve the bottom line. Data-driven perceptions of e-commerce products could help brands optimize supply chains to maximize sales. A business could determine the main areas that need attention depending on the product availability analysis on particular e-commerce channels, related discounts, and zip-code demands & supply statistics.

Let’s go through a few trend analyses and insights about well-known FMCG brands in the Chocolate, Biscuits, and Malt drink categories identified by Actowiz Solutions.

Analytics Procedure: Data Analysis Overview

- Data Extract period: January-August 2022

- Grocery Retailers pursued: Amazon Fresh, Dmart, Jiomart, BigBasket, Milkbasket, Swiggy

- FMCG Brands: ITC, Mondelez, Britannia, Parle, Complan, Nestle, Hershey’s, Boost, Amul

- Category followed: Biscuits, Malt drinks, Chocolate

Availability Analysis

Availability of Biscuits, Malt Drinks, and Chocolate on Leading E-Commerce Portals

FMCG brands can use the Availability analytics of Actowiz Solutions to manage their stock and inventory planning. Brands could also make data-driven decisions about product visibility, i.e., recognize which product to list on which platform.

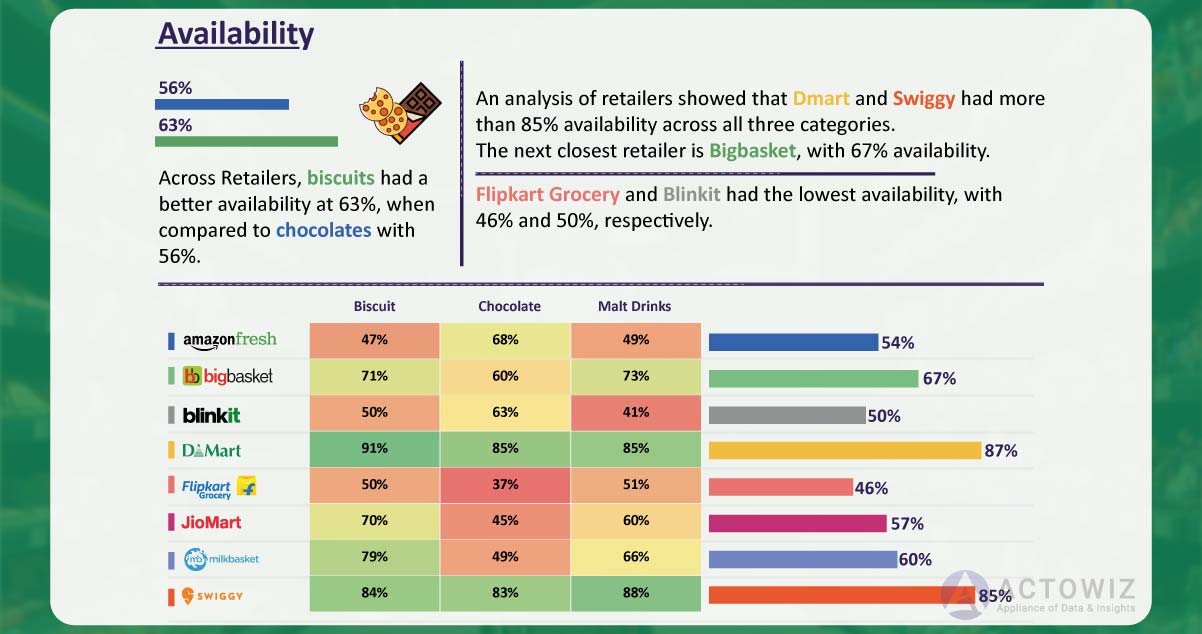

- Biscuits had a superior availability (63%) compared to chocolates (56%) across different retailers.

- Blinkit and Flipkart Grocery had the lowest availability at 50% and 46%, respectively.

- Swiggy and Dmart had over 85% availability in all three categories, having Bigbasket coming after that with 67% availability.

Availability

Manufacturers have the highest product availability on e-commerce platforms.

All five manufacturers have marked around 50% availability in the biscuits category during Jan 2022. Availability gradually grew to 68% during June 2022 and then declined to 63% during Aug 2022.

Mondelez had seen the biggest availability rise with an increase of 23% between Mar-Aug 22.

Unibic experienced the most significant availability drop, dropping 15% between May-Aug 22.

Availability Biscuits

- In the category of biscuits, all the five manufacturers have marked around 50% availability during Jan 2022. Availability gradually grew to 68% during June 2022 and then declined at 63% during Aug 2022.

- Mondelez had seen the biggest availability rise with an increase of 23% between Mar-Aug 22.

- Unibic had experienced the biggest availability drop, dropping 15% between May-Aug 22.

Availability Malt Drinks

Except for Nestle and Boost, availability for seven malt drink manufacturers was constantly over 50%. This availability increased gradually from January 22 (55%) to July 22 (63%), followed by a decline of 57% during August.

Except for Nestle and Boost, availability for seven malt drink manufacturers was constantly over 50%. This availability increased gradually from January 22 (55%) to July 22 (63%), followed by a decline of 57% during August.

From the availability of 30% on January 22 to only 7% on August 22, Boost has experienced the most significant availability drop.

Amul availability has increased the most in the last year, from 51% (January 22) to 78% (August 22), reaching 80% on July 22.

Chocolate: Manufacturers having the maximum availability of products on e-commerce platforms

Availability Chocolate

Chocolate availability in all the manufacturers averaged 47% during Jan-22, peaked at 64% during May-22, and decreased to 51% during Aug-22.

From 46% during Jan-22 to 74% during May, Mondelez has seen the most significant increase in availability, trailed by the decline of 68% during August.

Ferrero practiced among the sharpest availability drops. Although the brand availability progressively grew from 77% (January 22) to 94% (July 22), it registered a sharp decline (49%) on August 22.

The availability drop hurts a Brand’s eCommerce in two ways. Not only does a Brand loses sales directly, but poor availability also affects the keyword search rank, which further harms the sales.

Check Digital Shelf Analytics of Actowiz Solutions for insights about how Availability tracking could help you reduce the stock-outs and increase sales. To know more, click here!

Discount Analysis

Retailer-based, location-based, and manufacturer-based discounted trends could get analyzed. The studies could help companies plan appropriate and attractive discount and promotional strategies to improve revenue opportunities.

Which manufacturers have been providing the maximum discounts?

A study about discounts provided across different manufacturers for malt drinks, chocolates, and biscuits suggests that a few brands have increased values, whereas others have decreased their discounts. These decisions might be taken because of availability, demands, and production cycle. For example, Parle has progressively reduced the discount rates.

Average discounted rates across different manufacturers were about 9% during Jan 2022 and increased progressively to 14% during Jul 2022. A smaller decline is detected post-July, having a 12% discount registered during Aug 2022.

In the biscuits category, Unibic provided the largest discount (28%), trailed by ITC (20%).

In the Chocolate category, Hershey’s provided the most significant discount (14%), trailed by ITC (12%).

In Malt Drink Category, Amul provided the most significant discount (16%), trailed by Boost (10%).

Get Actowiz Solutions’ Product Digital Shelf Analytics for insights to react to Competitors’ prices and promotions. To know more, click here!

Search Analysis Share

Which brands feature in the top 5 on search’s first page?

Britannia rules the top ten search across various retail platforms online.

Mondelez has the peak share of searches at 62% (Amazon Fresh), while Parle-G has the lowermost search share at 7%.

In the Bigbasket app, Britannia has the maximum search share (62%), whereas Parle-G has the lowermost search share (7%).

Get Actowiz Solutions’ Product Digital Shelf Analytics for insights to react to Competitors’ prices and promotions. To know more, click here!

Conclusion

FMCG is a quickly evolving industry with higher potential growth in the upcoming years. Different FMCG brands should compete to tap the available market opportunities on many factors to ensure that the products get available, visible, and desirable to consumers.

Actowiz Solutions for FMCG Brands

Actowiz Solutions has been dealing with global FMCG brands to drive them towards growth on different e-commerce websites and apps by allowing them to monitor key metrics, identify improvement areas, mention action, and assess interventions’ impact. Actowiz Solutions’ KPIs help Brands to complete the empty spots in the funnel data and help them respond to the competitors on a real-time basis.

If you want to know more about leveraging Actowiz Solutions’ data insights and advanced sales, contact Actowiz Solutions now!

Sources: https://www.actowizsolutions.com/digital-shelf-insights-indian-fmcg-brands.php